How AI and federal funding can revolutionize city budgets

Before I launch into this week’s topic, I’d like to share some updates. As many of you know, I am consulting at Funkhouser & Associates, the firm started by Mark Funkhouser—or Mayor Funk as he’s known to most! Through my work there and my genuine interest in reading federal policy documents (weird, I know), I’m honing in on a way to talk about this new era of community investment that I hope is useful, digestible and actionable.

I’ll be trying that out in a couple places —>

A FREE online cohort series around how leaders can use federal funding to build livable communities. Learn more about how to apply.

Mayor Funk and I are presenting on the American Rescue Plan Act (ARPA) and the Infrastructure Investment and Jobs (IIJA) act next month at the New England States GFOA spring conference. View the agenda/register.

OK, onto the main event. If you missed Part One of this two-parter, click here.

Two experiments to make who and how we tax more equitable

The big takeaway from the GFOA’s Rethinking Revenue project is that the modern economy is shifting the tax burden toward those who can least afford it. Now, the association and its partners are launching pilot programs to test some of the ideas the project has explored.

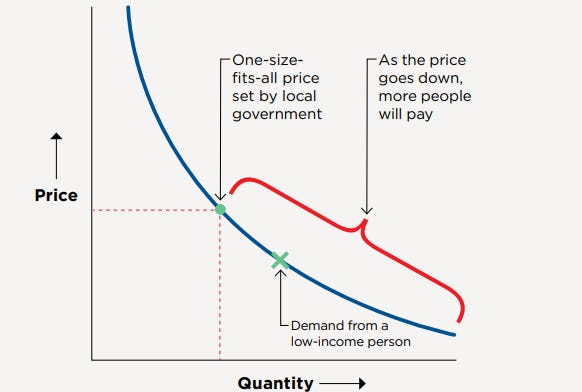

One will target the inequities built into relying on fees and fines and the GFOA is inviting governments to apply for a pilot project testing segmented pricing as a potential solution. Instead of a one-size-fits-all fine, segmented pricing is designed around a user’s ability or willingness to pay. For example, a $100 speeding ticket for someone who earns just $500 a week is a much larger financial burden than it is for someone who earns $2,000 a week. So for the lower-income transgressor, the fine is lowered to $50. It still stings, but it’s much more likely to get paid.

Shane Kavanagh, GFOA’s senior manager of research, said they’re looking for around five places to test this idea and that the tested revenue source would have to be large enough (such as traffic fines) and also be one that the government has had difficulty collecting.

The second pilot would test the idea of Urban Wealth Funds as a revenue source. The gist is that the public sector owns a lot of commercial assets (airports, convention centers, utilities) but it doesn’t manage the risk of increased costs associated with those assets very well. Cities could realize their hidden wealth potential if their commercial assets were bundled together and managed by a politically independent Urban Wealth Fund that could ultimately turn those assets into bigger profit-generators.

Read more

You can learn more about these pilots by contacting research@gfoa.org.

Using AI to build more equitable city revenues

It’s hard to imagine implementing some of these major ideas without using automation or AI.

Keep reading with a 7-day free trial

Subscribe to Long Story Short to keep reading this post and get 7 days of free access to the full post archives.