Happy Friday folks! This week I was sent a Substack post by the economist Michael Hicks, whom I’ve had the pleasure of seeing speak a few times. Hicks’ work focuses largely on measuring quality of life in the framework of government spending. His recent post and super-compelling graph got me thinking about how much stock we should be putting in things like tax burden rankings or “business friendly” state rankings. They matter. But generally not in the way they’re advertised.

But first, a quick reminder that if you’ve been thinking about pulling the trigger on a paid subscription, my 15% off promotion ends soon. Find out what’s below that line!

Taxes 101: You get what you pay for

Seems obvious—if you pay for more stuff you get more stuff (or better stuff), and vice versa. Yet when it comes to taxation, this basic principle tends to be forgotten by a lot of elected officials. Hicks’ research draws a clear correlation between spending and services.

“There is variation, yes, but all in all, places that spend more of their incomes on government services enjoy more and better government services,” he writes. “[A]s these data make clear, spending is driving quality and quantity of public services. And, almost nothing matters as much as education.”

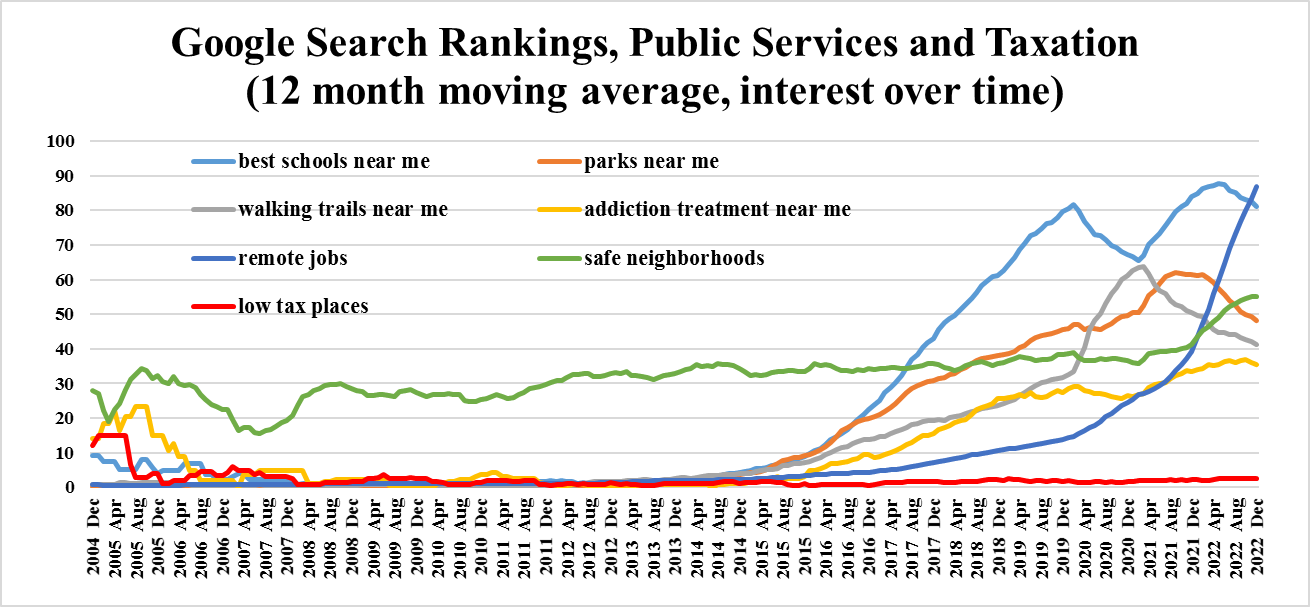

Hicks shows that the general public gets it too. We don’t care nearly as much about low taxes as we do about quality of life.

Hicks has previously published research that shows quality services drive relocation decisions more than tax rate, which is a counterargument to the race-to-the-bottom notion that lowering taxes will grow the economy. But these days, as remote work has given many people a little more freedom of choice in where they live, quality services are arguably the top growth driver for a city’s tax base.

Real estate companies figured this out a long time ago. There’s a reason platforms like Zillow or Redfin include things like school ratings, bike score, walk score and other amenities but don’t bother with tax burden ranking (beyond just showing the property tax history).

I often hear city politicians argue for tax cuts by saying their taxes are too high compared with the surrounding suburbs. Well of course they’re higher—cities have better public transit, more walkability and cultural amenities like museums and sports stadiums. Businesses may have their headquarters in lower-tax places but they will still have employees and payroll taxes in major cities because they still want that mailing address.

Tax rankings still matter. The thing is, it’s pretty easy to spend a lot of money poorly and harder to spend it smartly. There are plenty of high-tax places that still don’t have great public services and amenities. What matters is quality. Tax burden rankings serve a purpose in that they tell us who’s probably spending more on public amenities and who’s not. But it’s the other rankings—schools, walkability, parks—that will tell us how well they’re spending that money.

Budgeting for priorities

Knowing what taxpayers really value is step one. Step two is aligning spending with those values.

Keep reading with a 7-day free trial

Subscribe to Long Story Short to keep reading this post and get 7 days of free access to the full post archives.