What do rising interest rates mean for government debt?

The Fed has been bumping up rates for the past year to combat inflation. Here's how that's playing out in the municipal market.

Happy Finance Friday, readers!

I’m still on vacation so this week’s post is guest written by Martin Feinstein, managing director of DebtBook, a debt, lease, and subscription management software for governments. He explains how rising interest rates are affecting the municipal bond market. From the bondholder’s perspective, the volatility means that the value of their bonds decrease when interest rates rise.

Rising rates increase the cost of borrowing for governments because they’re paying higher rates on the bonds they issue in the municipal market. But it also affects their existing debt.

“The two main types of debt issuances, new project financings and refunding financings, are impacted differently,” Martin writes. Here’s more from Martin:

New Project Financings

The higher the interest rates, the more costly the financing of a new project is over the long run, thus increasing pressure on the municipal budget.

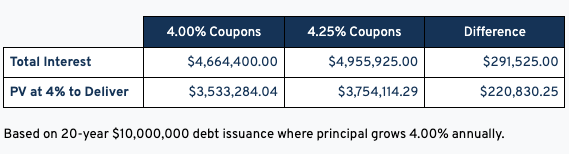

The example below compares the cost of a 20-year, $10 million debt issuance at different rates. “Coupons” refer to the interest rate that bondholders get back on their investment. “PV” stands for “present value,” or the face value of the bonds when they’re issued.

The results displayed above show that an increase of just 0.25% on the bonds used to finance the project will cost the issuer an additional 6.25% in interest over the life of the 20-year financing, or in today’s dollars, an additional $220,830.25. (Please note: the results will differ depending on the structure of the bond financing, e.g., level debt, deferred principal payments, etc.)

Refinancings

The higher the bond yield environment, the less cash flow savings that refundings (refinancing existing debt) will achieve.

The yield and the coupon on a bond drive the price of the bond. As yield and price are inversely related, if the yield of a bond increases, the price decreases, and vice versa. In a high yield environment, an issuer has to sell more bonds to generate the necessary proceeds to pay off the old bonds, thereby decreasing the potential savings a refunding can produce when compared to a lower rate environment.

Refunding economics are based on replacing an existing transaction’s cash flow (the principal and interest payments of the current bonds) with a transaction that has a lower cash flow (the “refunding” bonds). If the original bonds were sold in a higher coupon/yield environment than the refunding bonds, based on the structure of the refunding bonds, the annual interest payments made by the issuer would be reduced thus producing future cash flow savings and budgetary relief.

To show how both the coupons and the yield define the cash flow savings achieved from a refunding, below we compare refunding an outstanding $100 million debt issuance from 2013 that has 10 years left until final maturity. The bonds were initially issued with 4.50% coupons.

The chart below shows four different scenarios. Remember, the coupon rate is the interest amount paid to the bondholder by the issuer until its date of maturity. On the other hand, the yield to maturity is the total return earned by the investor to maturity.

The results above display that the savings achieved by the refunding are drastically reduced by 25 basis points (0.25%) with an increase in the coupon on the refunding bonds. Also of note:

The savings increase dramatically when the bond’s yield is lower than its coupon rate.

The lower the refunding bond’s yield, the more savings produced.

You’ll notice the refunding bonds sold at 3.50% coupon/3.25% yield and 3.75% coupon/3.25% yield produce close to the same savings. This is due to the high price of the 3.75% coupon/3.25% yield bonds.

Last, it’s important to know the savings breakeven threshold . Look at the minimal savings in the 3.75% coupon/3.75% yield scenario. If the refunding bonds were sold at 3.80% coupons/yield, there would be no future savings produced by the refunding bonds.

Takeaways

In summary, even the smallest change in interest rates/yields can have a large effect on:

How much a project will cost an issuer

The economics achievable by a refunding (refinancing) of an already outstanding transaction

As interest rates increase/yield increase, issuers must decide if the economics of projects are feasible, whether being paid off with future tax revenues or project revenues. On the refinancing front, the economics of a refunding must produce savings, or the issuer will have to continue paying off the existing outstanding bonds until maturity.

DebtBook works with government, higher education, and healthcare finance teams and provides debt, lease, and subscription management software that makes it easier to comply with Governmental Accounting Standards Board requirements.

Disclaimer: DebtBook does not provide professional services or advice. DebtBook has prepared these materials for general informational and educational purposes, which means we have not tailored the information to your specific circumstances. Please consult your professional advisors before taking action based on any information in these materials. Any use of this information is solely at your own risk.