These governments are running out of time

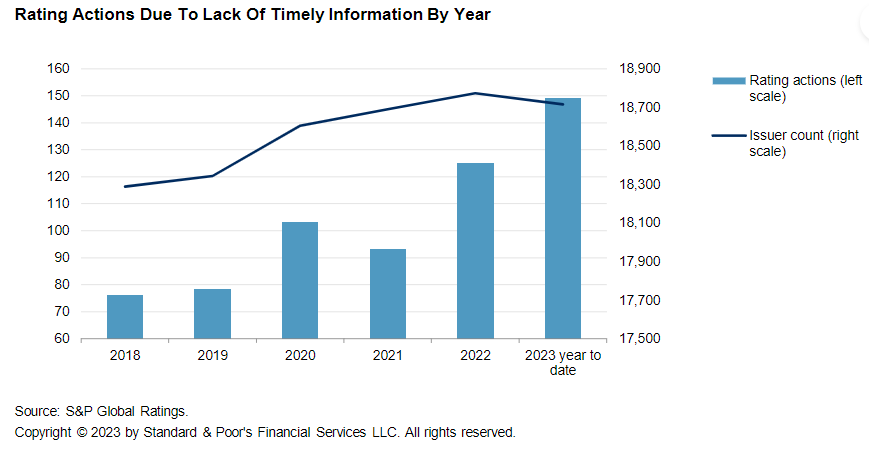

S&P has put nearly 150 issuers on notice to produce financial information or else face the consequences.

Happy Finance Friday! Earlier this month, S&P Global Ratings issued a piece on a lack of timely disclosures by local governments. This is a perennial topic (rant) among municipal market stakeholders but this one had a twist: staffing shortages are leading to even worse lags in financial reporting.

This is a big deal. As you’ve heard from me before, financial transparency and faith in government (and the people who run them) are inextricably linked. When things go south, costs start going up and that spiral is tough to exit.

Slow financial reporting can lead to downgrades

Less than three months into the year, S&P Global Ratings has already placed 149 entities it rates on “CreditWatch with negative implications” because the ratings company has not yet received 2021 financial statements from these issuers.

“In order to maintain our ratings, we rely on the timely disclosure of financial and related information relevant to our credit analysis,” S&P said.

We view proactive disclosure and dissemination of information as a positive management characteristic. Conversely, we view the lack of timely disclosure and information flow negatively. On a year-over-year basis, we have recorded a notable increase in negative rating actions due to information sufficiency and quality considerations.

S&P goes on to say that the reporting gap seems to be due to staffing shortages at auditing firms. Annual Comprehensive Financial Reports (ACFRs) must be certified by an external auditor and fewer auditors means delays in filing the ACFR. In addition, “issuers have faced staffing turnover in key reporting departments, which has further contributed to delayed reporting.”

Timeliness is a basic concept of financial reporting because, as the Government Finance Officers Association notes, “financial reports must be available in time to inform decision making.” Reports should be published “as soon as possible after the end of the reporting period” and although “governments certainly should not sacrifice reliability for timeliness, minor gains in precision ought not to be purchased at the price of indefinite delay.”

Most governments take around nine months to produce their audited financial report. It’s been 21 months since fiscal 2021 closed for governments that end their fiscal years on June 30.

This isn’t just a problem relegated to small governments with questionable credit quality. To be fair, most of these places are smaller. Still, the list of local governments S&P has placed on a ratings watch includes places you’ve probably heard of—and with good credit ratings to boot, including:

Danbury, Connecticut (Credit rating: AA+. Population: 86,759)

Jefferson County, Missouri (Credit rating: AA. Population: 227,771)

PLUS: Three other Jefferson County issuers rated between AA- and AA)

Jersey City, New Jersey (Credit rating: AA-. Population: 283,927)

Mercer County, New Jersey, home to Trenton (Credit rating: AA+. Population: 385,898)

Santa Fe, New Mexico (Credit rating: AA. Population: 88,193)

PLUS: Four other Santa Fe public issuers rated between AA and AAA)

I can’t list all 149 but if you want to know if your municipality is on the list, reply here or email me and I’ll check for you.

What’s next? Given the acute shortage of certified public accountants reported by the American Institute of CPAs, S&P says the number of delayed disclosures could further increase in the near term.

Read about the AICPA’s effort to strengthen the shrinking accounting pipeline.

S&P has given government issuers until mid-April to produce 2021 financial statements or face a possible rating downgrade or a complete withdrawal of their credit rating. If either of those happens, the government’s borrowing costs will likely increase the next time it issues debt. And in an environment where interest rates are already high, governments can ill-afford to tack on additional, self-inflicted costs.

Are the massive federal funding bills to blame?

Well, not directly. But—and not to look a gift horse in the mouth—there’s an indirect case to be made that governments and accounting firms were given more than a lot of them can handle.

These governments are being flagged because they haven’t posted an ACFR since 2021—the same year the American Rescue Plan Act (ARPA) was enacted. Ever since ARPA passed, state and local government finance officers have worried about their capacity to comply with the accounting and reporting requirements that came with that federal funding. Local governments are struggling to staff back up and now have more work to do than ever.

I wrote about it for Route Fifty in July 2021 and the hand-wringing was universal:

For smaller governments, it's the prospect of being subject to new accountability auditing that will be daunting for many jurisdictions. For larger governments, ARPA requires sophisticated performance and outcomes reporting that most don’t regularly do.

It was expected that these reporting requirements would both increase the workload for finance staff while also upping the demand for accountants at firms that audit financial statements and conduct legally-required Single Audits for governments spending more than $750,000 in federal funds.

Mary Foelster, senior director for the AICPA, told me at the time that “for the most part,” governments should be able to find an auditor because of relaxed rules around remote auditing and additional training efforts by the association. Still, she said, “we do worry a bit about workload compression.”

And that was just for ARPA. Since then, two more massive federal spending bills have passed which means more external audits and more demands on accounting firms and government finance staff.

Why timeliness matters to taxpayers

The repercussions of slow financial reporting all add up to more costs for taxpayers. For one, a lower credit rating and associated higher borrowing costs mean governments (and their residents) get less bang for their buck in the municipal market. So, schools, parks and other infrastructure gets more expensive.

Also, policymakers don’t have all the information, they risk making costly choices. It may not seem like that at the time. After all, lots of places produce revenue forecast updates and other non-audited information about the current outlook for government expenditures and revenues. But, as I’ve written about before, without the big picture view that ACFRs provide, elected officials can make short-term decisions that have a negative long-term impact.

It’s also no coincidence that financially distressed cities tend to be way behind on their financial reporting. Chester, Pennsylvania, for example, hasn’t produced an audited report since 2018. More than once, the city has had to borrow money just to make payroll while residents are subjected to tax hikes and deteriorating services.

Bottom line, this erodes trust. Studies have shown that transparency can save governments money and the reverse is also true. In cities where local newspapers—the traditional government watchdogs—have shuttered, research shows those cities tend to pay higher borrowing costs because “potential lenders have greater difficulty evaluating the quality of public projects and the government officials in charge of these projects.” And when it comes to government officials and local taxpayers, trust is a basic currency. Without openness and transparency, it quickly loses value.

A problem beyond the shortage of CPAs is that some municipal audit firms are exiting the business. It tends to be a high-burnout, low-margin business. We recently had one firm here in Oregon that was a mainstay of the municipal audit field stop taking on new audit clients to focus on their consulting business.