Why cutting budgets in the next slowdown will be harder

Unlike prior downturns, states can't lean on workforce cuts to balance budgets.

Happy Finance Friday readers!

I’ve been prepping this week for a presentation I’m participating in next week and one big takeaway has emerged from the data I’ve been sifting through: During the next revenue slowdown (which, FYI, is now), states will have fewer options than perhaps ever to balance their budgets. Here’s what I’m seeing.

How states are right-sizing their budgets

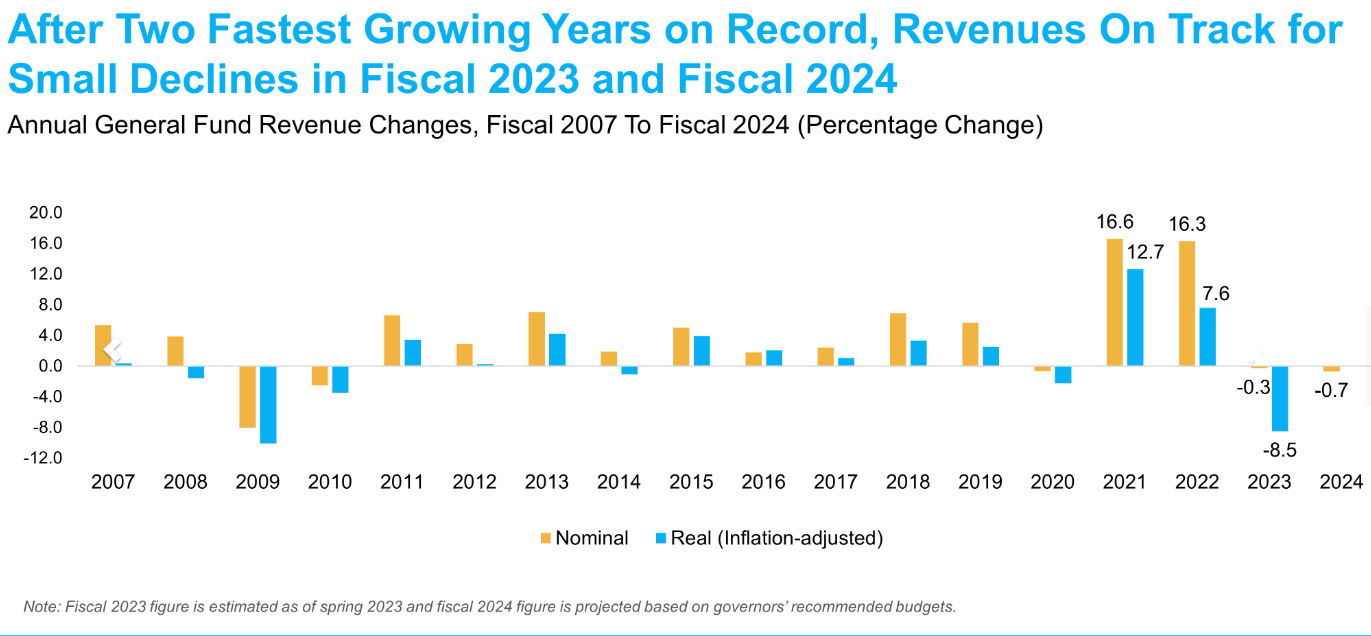

State revenues have been slowing since earlier this year after two years of unusually high growth. Imagine you got an extra month’s pay last year without doing any extra work and that’s essentially what has happened for the last two fiscal years.

As States Plan for Next Year’s Budget, the Economy Flashes Mixed Signals

Well, no more. This graph from the National Association of State Budget Officers (NASBO) shows that total inflation-adjusted state revenue declined in Fiscal 2023, which ended June 30. And this year, states are prepping for less overall income.

This slowdown (or some might say return to normal) combined with the expiration of federal Covid relief dollars creates somewhat of a fiscal tightrope for state budget offices. Yes, the pandemic relief funding was one-time money and we all knew that but that didn’t stop a lot of places from using it for ongoing programs.

The States That Could be Headed for a ‘Fiscal Cliff’ - Route Fifty

I took a look at what the latest NASBO report says about the number of states that made different types of revenue adjustments last year. Here’s the tally.

Moving money around is the most popular choice and for good reason. State rainy day funds are at an all-time high and most states have also banked budget surpluses in the last few years, so they have the financial flexibility to tap these reserves. (Note: some states have more strict requirements for withdrawing from their savings so those budget offices might be more inclined to keep their general fund balance a little higher to maintain flexibility.)

What won’t states do?

You probably noticed in the above chart that no state is making cuts related to its workforce. Nor can they afford to.

Keep reading with a 7-day free trial

Subscribe to Long Story Short to keep reading this post and get 7 days of free access to the full post archives.